-

HEALTH INSURANCE IS A FOUR LETTER WORD

- Jun 01, 2017

- By Troy Kerr

- In HEALTH & FINANCE

To say that people are disenchanted with the health insurance industry is an understatement. It’s no longer front page news, either. In light of the current political climate, and with uncertainty still looming over Obamacare 2.0, the Affordable Care Act, Medicaid, and healthcare reform in general, we’re seeing the effects this uncertainty is having on our clients in the health care and affiliated industries.

Perhaps nowhere is this topic more complicated, and more emotionally charged, than in the health insurance arena.

As any goal-oriented, data-driven, insight-minded agency would do for its clients in a situation like this, we needed to understand the root of the problem – where these frustrations were originating – and what could be done to mitigate consumers’ fears.

So we asked them. We talked to health insurance consumers around the country, as well as to human resources professionals responsible for making the health insurance decisions for organizations large and small. We found out what their pain points were, what they liked, what they disliked, and their general perceptions of the health insurance industry as a whole.

We knew the public was unhappy with health insurance, but we didn’t know just how dire the situation was. Yes, the future of health care is UNCERTAIN. Yes, customers and administrators are increasingly FRUSTRATED and SKEPTICAL. But we certainly didn’t expect to hear responses as vitriol as these:

We knew the public was unhappy with health insurance, but we didn’t know just how dire the situation was. Yes, the future of health care is UNCERTAIN. Yes, customers and administrators are increasingly FRUSTRATED and SKEPTICAL. But we certainly didn’t expect to hear responses as vitriol as these:“Shady, untruthful, and confusing.”

“Complicated and money-grubbing.”

“Necessary evil.”

“I analyze the data regarding employer premiums as well as premiums on the market. I review salaries for executives working at the main insurance providers. Usually while drinking a glass of wine to dull the pain.”

“A mystery wrapped in a puzzle.”

“The health insurance industry is more concerned with their bottom line than with serving their customers.”

“A scam.”

“Huge increases to premiums. Severely bloated salaries for their executives.”

“Scumbag money swindlers!”

It sounds bad, and that’s putting it nicely. But there’s a silver lining. Reading between the lines of these pleas, a tremendous opportunity exists for one health insurer to step up and take ownership of the problem. To become the biggest part of a complex solution by simply choosing to hold themselves accountable to higher standards.

Which is how, as an agency, we arrived at the following INSIGHT>FACT>STRATEGY progression.

The INSIGHT: Individuals and plan administrators don’t believe that health insurance companies are working with their best interests in mind.

The INSIGHT: Individuals and plan administrators don’t believe that health insurance companies are working with their best interests in mind.The FACT: [LUCKY HEALTH INSURANCE COMPANY] exists to take care of our customers.

The STRATEGY: WE HEAR YOU.

WE. HEAR. YOU. Three simple words that when used together, convey empathy, compassion, sincerity, understanding, and dissatisfaction with the current state of affairs. But it’s one thing to merely hear someone. It’s another thing to lead by example. So the phrase “We hear you” needs to be part of a broader movement, something along the lines of, “We hear you. We’re different. And here’s what we’re doing about it.”

It’s a position that not everyone is willing – or even able – to own. But for one lucky health insurer who jumps on this opportunity first, their long term prognosis calls for a full recovery.

-

Millennials and Credit Unions

- May 24, 2017

- By Troy Kerr

- In HEALTH & FINANCE

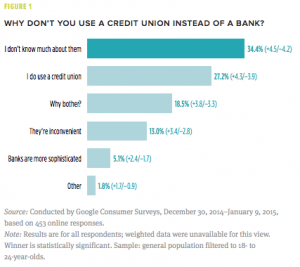

FPO COPY – Guess what? Millennials don’t use credit unions because they don’t know much about them. They tend to default to bigger banks and then stick with them, because it’s a hassle to change banks once multiple online payments are tied to one card. Specifically, the “membership” concept is confusing. Millennials are inclined to think that they have to be “eligible” to be a member.

We found it interesting that the idea of a “community bank” has much more cache than “credit union” among this group.

We found it interesting that the idea of a “community bank” has much more cache than “credit union” among this group.Through this and other articles I came across, it seems that one of the primary considerations for millennials when choosing a bank is digital service offerings. Their preferences are oriented toward quick interactions, either online or in a mobile app.

Read the entire white paper here.

Category “HEALTH & FINANCE”

© DVA Advertising & Public Relations

DVA Advertising & Public Relations is a mid-size, strategy-driven, full-service agency located in Bend, Oregon. Established in 1990, we specialize in travel/tourism and destination marketing, outdoor sports and recreation, wine and craft beer, and health care and financial services categories.

DVA Advertising & Public Relations is a mid-size, strategy-driven, full-service agency located in Bend, Oregon. Established in 1990, we specialize in travel/tourism and destination marketing, outdoor sports and recreation, wine and craft beer, and health care and financial services categories.